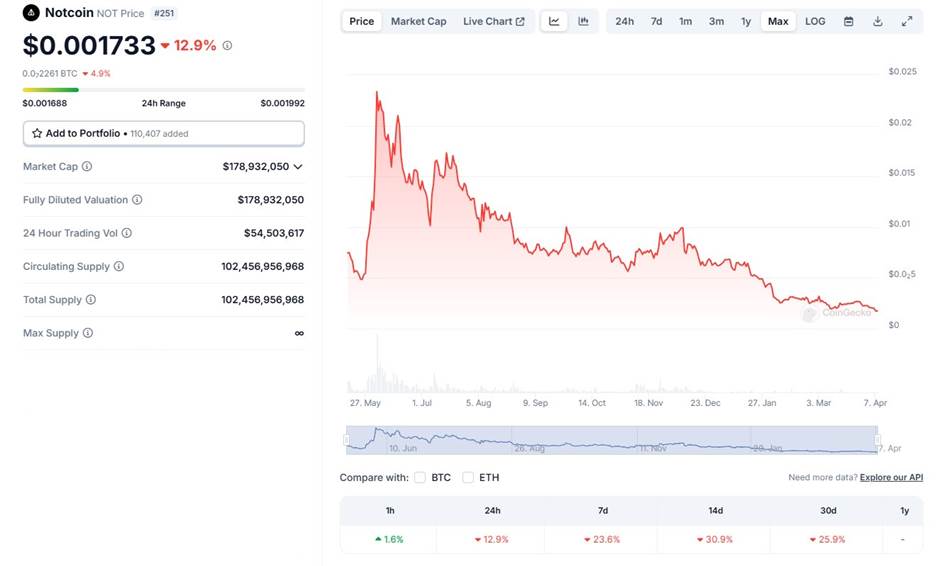

Notcoin (NOT) price has plunged over 12% as Bitcoin drops below $77,000 after a brief resilience following US retaliatory tariffs announced by President Donald Trump on ‘Liberation Day.’

This dramatic decline underscores the fragility of smaller cryptocurrencies amid a turbulent economic landscape.

Bitcoin, a dominant force in the crypto market, fell to a three-week low of $76,693.20 on April 7, 2025, pulling altcoins like Ethereum (ETH), Solana (SOL), XRP, and Notcoin (NOT) down with it.

Notcoin suffers as Trump’s tariffs disrupt the crypto market

The catalyst for today’s downturn traces back to April 2, 2025, dubbed ‘Liberation Day,’ when Trump unveiled sweeping tariffs aimed at nearly 200 US trading partners, igniting fears of a global trade war.

The tariffs, a cornerstone of Trump’s economic agenda, impose a baseline 10% duty on most imports, with steeper rates for specific nations—34% on Chinese goods and 20% on European Union products.

Designed to correct trade imbalances, these measures instead unleashed chaos across financial markets.

US stock futures cratered, with Nasdaq 100 contracts tumbling 5%, while global indices followed suit.

Asian markets plummeted as Japan’s Nikkei 225 shed 6%, and South Korea’s Kospi dropped 4.4%.

This widespread sell-off in traditional markets has spilled over into cryptocurrencies, erasing Bitcoin’s brief post-tariff stability and dragging the broader crypto ecosystem into a tailspin.

Notcoin, trading at $0.001748 as of April 6, 2025, has borne the brunt of this volatility. Its all-time high of $0.02836, hit on June 2, 2024, contrasts sharply with its recent low of $0.001688 on April 7, 2025—a 93.9% drop from its peak.

This steep fall highlights Notcoin’s vulnerability as a smaller-cap cryptocurrency, prone to exaggerated price swings when market sentiment sours.

Is a crypto winter on the horizon?

The economic fallout from the tariffs extends beyond immediate market reactions. Businesses face higher costs, which could fuel inflation, while consumers brace for pricier goods.

Hedge fund titan Bill Ackman has warned of an “economic nuclear winter” if these policies persist, citing irreparable damage to US global credibility.

In this climate of uncertainty, investors have fled riskier assets, with the Crypto Fear & Greed Index plunging to 17, signaling “extreme fear.”

On April 6, the crypto market saw $778 million in long positions liquidated in a single day, the largest such event in six weeks.

Over the past 24 hours, 327,264 traders have been liquidated, bringing the total liquidations to $1.02 billion according to Coinglass data.

Notably, Bitcoin’s decline has amplified the pressure on altcoins.

Ethereum, today, hit a low of $1,538, its lowest since October 2023, while Solana dropped to $107.

Notcoin, lacking Bitcoin’s robust institutional backing or market depth, has suffered disproportionately. Its 23.6% loss over the past week and 25.9% decline over the past month reflect a market in retreat, with traders favoring cash or safer havens over speculative tokens.

Arthur Hayes believes the instability could bolster crypto

BitMEX co-founder Arthur Hayes argues that prolonged economic instability could eventually bolster Bitcoin’s appeal as a decentralized hedge against centralized policies.

Freshly pardoned by Trump for past financial violations, Hayes envisions a scenario where investors seek refuge in Bitcoin (BTC), potentially lifting the broader crypto market.

Some of y’all are running scurred, but I LOVE TARIFFS, some chart porn to understand why.

Global imbalances will be corrected, and the pain papered over with printed money, which is good for $BTC.

933

Reply

Copy link

For now, though, such optimism remains distant as BTC teeters near $76,000, with analysts like Charles Edwards cautioning of a possible dip to $71,000 if support levels falter.

The tariffs’ long-term implications loom large. If they spark sustained inflation or a global slowdown, the Federal Reserve may face pressure to adjust monetary policy, perhaps adopting a dovish stance that could buoy risk assets.

Conversely, persistent trade tensions might deepen the downturn, keeping cryptocurrencies under strain.

Notcoin, emblematic of altcoins’ struggles, stands at a crossroads, its fate tied to both Bitcoin’s trajectory and the unfolding economic narrative.

The post Notcoin plunges as Bitcoin dips under $77,000 appeared first on Invezz