April’s numbers for inflation looked good. Producer prices dropped. Retail sales were flat. Some even said inflation was cooling.

But often, the real story is hiding in the details. What we’re seeing isn’t relief, but the start of something harder to measure and much more telling.

The tariffs are finally kicking in, and the real price shock hasn’t started yet.

What does the US inflation outlook look like for the rest of 2025?

Are prices really going down?

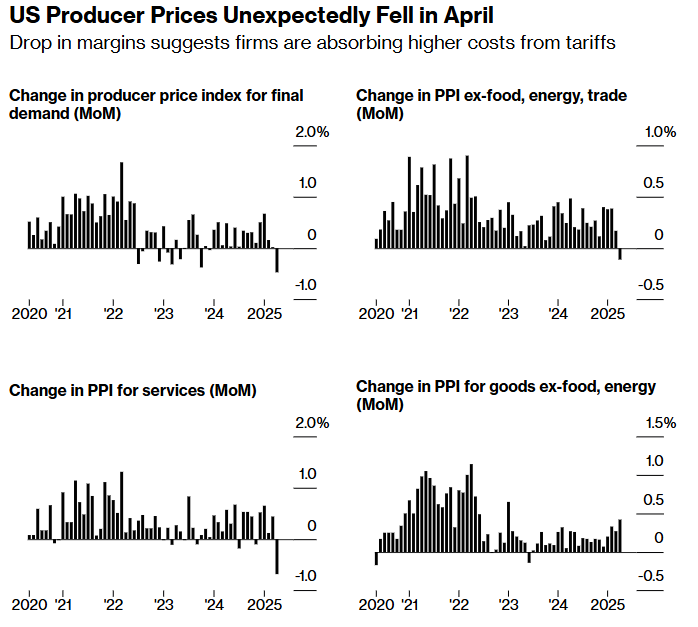

In April, US producer prices fell by 0.5%. That was the biggest monthly drop since the early pandemic and much steeper than the 0.2% rise economists had expected, according to Bureau of Labor Statistics data.

On the surface, this looked like progress in the inflation fight. It wasn’t.

The drop was mostly caused by falling margins in trade services. That’s the money businesses make between wholesale and retail.

A 1.7% collapse in that category tells us companies are swallowing higher costs rather than passing them on, for now.

Core PPI, which excludes food, energy and trade, also slipped by 0.1%.

But goods prices, especially those excluding food and energy, rose 0.4%, the fastest increase in more than two years.

This means businesses are paying more to make things, but they’re not raising prices yet. That can’t last forever.

Why are retailers holding back?

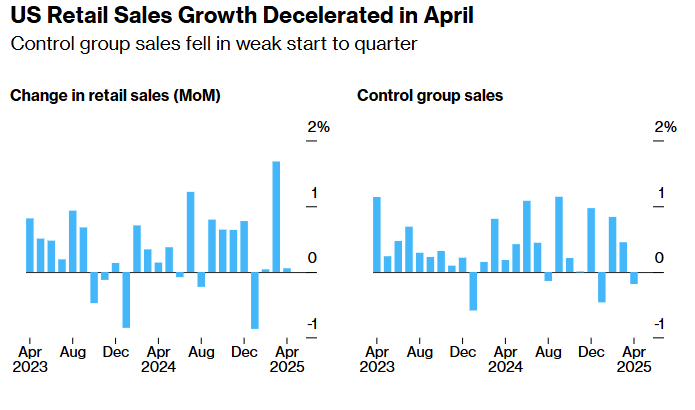

Retailers aren’t blind to what’s coming. They’re preparing. In March, sales jumped 1.7% as consumers rushed to buy before the Trump administration’s latest round of tariffs took effect.

In April, retail sales barely moved, up just 0.1%, while seven of the thirteen major categories fell. Control group sales, which feed into GDP, dropped by 0.2%.

Consumers are reacting to what they expect and not what they’ve already seen. That’s a key difference this time around. In 2018, it took several months for tariffs to push up prices on washing machines.

This time, the reaction is faster. The psychology of inflation has changed. People expect prices to rise. So they’re slowing down now.

Walmart confirmed it will start raising prices later this month. Electronics, toys and certain imported foods will be hit first. That move alone will shape the broader retail trend. If Walmart can’t hold prices down, smaller players won’t either.

What’s the Fed really watching?

Federal Reserve Chair Jerome Powell said this week the economy might be entering a period of more frequent supply shocks.

That means inflation won’t follow a smooth path. It will swing more sharply and unpredictably.

He warned that inflation “could be more volatile going forward than in the inter-crisis period of the 2010s.”

The Fed knows tariffs are supply shocks. They raise costs at the point of entry, filter through manufacturers and retailers, and only show up in CPI with a delay.

So while CPI looked soft in April, and core PCE is expected to stay near 2.9%, the groundwork for higher inflation later in the year is already being laid.

Markets still expect the Fed to cut interest rates at the next June meeting. But those cuts are being priced in based on current softness, not on what’s coming.

If inflation surprises to the upside in June or July, the Fed could be forced to hold rates steady, or even pause cuts entirely. That would catch both markets and consumers off guard.

How are companies reacting?

The pressure on corporate margins is no longer theoretical. It’s in the data. Retailers and manufacturers are quietly shifting strategies. Some are raising prices.

Others are pulling entire product lines that would be too expensive to sell at a profit. A few are leaning harder on suppliers or changing sourcing strategies altogether.

Walmart, with only about 15% of its products coming from China and a strong domestic grocery base, has more flexibility than most.

Even so, it couldn’t hold off forever. Its CEO called the current tariffs “too high” and said they can’t absorb the cost any longer.

Other companies like Target, Mattel and Home Depot are facing the same decisions. Trump’s tariffs have become both an economic cost and a political minefield.

When Amazon considered showing the added cost of tariffs on product pages, it was met with threats.

Even Walmart, which is typically careful with political statements, openly criticized the tariffs this week.

What does the data really say?

It says the squeeze is on. Companies are taking the hit on margins. Consumers are pulling back before prices rise.

Goods prices, especially imported ones, are creeping up underneath the surface. Services inflation is soft, but that may not last if wage growth holds and travel demand returns.

The full inflation picture is not yet visible in headline CPI or PCE. But it’s already forming in core goods categories and corporate earnings calls.

If the data holds, we’re two to three months away from seeing it clearly in consumer-level reports.

US inflation 2025 outlook: What to expect

Inflation in 2025 is running on a delayed fuse. Producer prices dropped because businesses took the hit. But that’s only sustainable for a short time.

The timeline now looks like this:

May–June: Retailers begin raising prices. Walmart and others implement selective hikes on tariff-exposed goods.

June–July: CPI begins to reflect higher prices in consumer goods. Core inflation ticks higher.

July–September: Margin compression eases as pass-through accelerates. Fed reassesses its rate path. Market expectations for cuts begin to shift.

The price increases won’t be massive at first. They’ll show up in targeted categories like electronics, toys, appliances, food staples with high import ratios.

But the direction will be clear. Inflation is not falling. It’s just being delayed by a short-term buffer.

Walmart was “canary in the coal mine”. We can expect that more retailers will follow by mid-June.

What comes next is less predictable. If tariffs continue to change, inflation volatility will increase. Consumers will keep adjusting their expectations faster than models can capture.

And the Fed’s ability to guide policy based on backward-looking data will be tested more than at any point since 2022.

For now, prices feel stable. But underneath, the system is already moving. By the time we see it clearly, the inflation narrative will have already turned.

The post Inflation outlook in 2025: what April’s soft data isn’t telling you appeared first on Invezz