This is the first time in modern history that none of the three major credit rating agencies (Moody’s, S&P, Fitch) see US sovereign debt as top-tier.

However, there is no panic in the markets so far. Treasury yields ticked higher, the S&P dipped slightly, and most headlines moved on.

The US is facing a long-building financial fracture that is slowly beginning to show at the surface.

Moody’s downgrade may not trigger a crisis, but it confirms what many have feared for years. The US is running out of room to ignore its debt problem.

And as Congress pushes forward with a new multi-trillion-dollar tax package, things are about to get more fragile.

Is this really a turning point?

Moody’s downgrade from Aaa to Aa1 is more than a rating change. It is the final step in a slow, global recalibration of how reliable US finances appear.

S&P Global pulled its top rating in 2011. Fitch followed in 2023.

Moody’s held out the longest, but even they have now stated that America’s “significant strengths no longer fully counterbalance the decline in fiscal metrics.”

The timing wasn’t accidental. The US debt is getting close to $37 trillion.

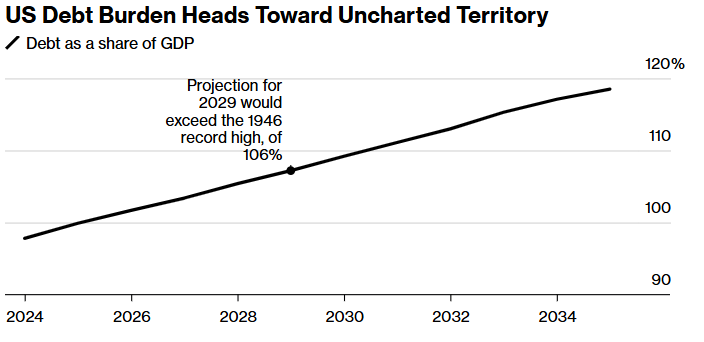

This amounts to around $106,000 per American. It now exceeds the size of the entire economy and is projected to hit 107% of GDP by 2029.

In the 2024 fiscal year alone, the federal government ran a deficit of $1.8 trillion, its fifth consecutive year over the $1 trillion mark.

Interest payments are climbing fast too. In 2017, the government paid $263 billion in interest. This year, it is projected to spend $1 trillion just to service its debt.

According to Moody’s, that cost will consume nearly 30% of all federal revenue by 2035, up from 18% today.

And this is before the Trump administration’s new tax and spending bill even becomes law.

What’s actually in the new tax plan?

The bill that just advanced in the House Budget Committee aims to lock in the lower income tax rates from Trump’s 2017 package, eliminate taxes on tips and overtime, and expand deductions for seniors and families.

But the problem is not just what it offers, but how it is structured.

Many of the bill’s provisions are set to expire in four years, which lowers their cost on paper. Politically, however, they will be almost impossible to reverse.

That’s why the Committee for a Responsible Federal Budget says the real cost could reach $5.2 trillion over the next decade, even though the official score is $3.8 trillion.

Republicans say the tax cuts will spur growth, bring in more revenue through tariffs, and be offset by $1.5 trillion in spending reductions, largely from Medicaid.

But most of those savings are undefined or depend on future policy changes. In the meantime, the cost is very real.

Even after accounting for planned cuts and tariff revenue, independent estimates still show a net increase in the deficit of around $3.3 trillion.

Why are the markets not reacting?

Despite everything, investors are still buyingTreasuries. The US dollar is still the global reserve currency. And no one expects the US to default. These are powerful buffers. But they are not permanent.

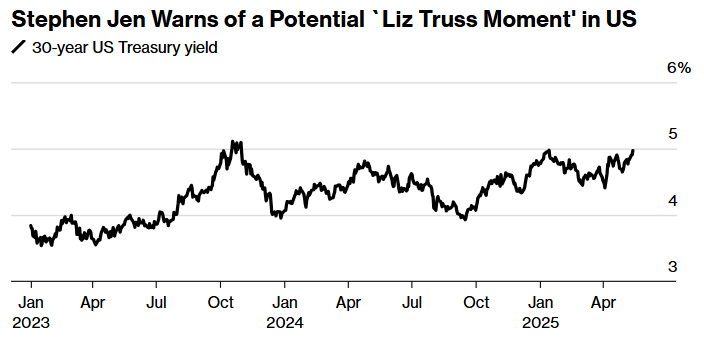

Ten-year Treasury yields have already risen toward 4.5%. Thirty-year yields are close to 5%.

There’s more supply coming too. Former Treasury official Jim Millstein warned last week that deficits could jump to $4 trillion if a recession hits, since revenues fall and emergency spending rises.

Millstein isn’t alone. Market veteran Stephen Jen says the US may need its own version of the UK’s 2022 “Truss moment,” where bond markets revolt and force policy changes.

That moment hasn’t come yet, but the ingredients are gathering.

What happens if nothing changes?

The bigger question is what happens if Congress does pass this bill, or if it passes something even more expensive.

According to the Government Accountability Office, the US is on track to double its debt-to-GDP ratio by 2047.

Moody’s estimates federal deficits could reach 9% of GDP by 2035. If interest rates stay where they are, or rise even further, that scenario becomes unmanageable.

There are only three levers in this situation: tax increases, spending cuts, or inflation. So far, neither party supports the first two. The third one may arrive on its own.

The bond market is now the real check on Congress

In the 1990s, the US brought its deficit down partly because bond markets demanded it. That pressure is building again.

But this time, the debt is larger, the political climate is more fractured, and interest costs are higher.

What’s different now is that warnings aren’t just coming from think tanks or credit agencies.

They are coming from the price of money itself. Higher yields are no longer about Fed policy. They are about risk.

Investors should pay attention to supply. Treasury issuance is set to rise significantly as deficits widen.

Following the auctions, especially in long-dated paper, signs of weak demand are beginning to appear, shorter bid tails, and larger primary dealer take-up.

Political ceiling should not be underestimated in this case. If markets start doubting the credibility of the proposed fiscal enforcement, yields could rise further, regardless of inflation trends.

For fixed income investors, duration exposure should be carefully evaluated. Alternatively, equity investors should pay attention to companies with weak balance sheets as real yields rise.

Ultimately, the US hasn’t hit a wall. But it’s no longer moving in the dark. Everyone can see what’s ahead.

The only question left is whether it will act before markets do it for them.

The post Why the US debt problem is getting too big to ignore appeared first on Invezz