According to a new research released Tuesday by the Organisation for Economic Cooperation and Development (OECD), the global economy is likely to slow in the coming two years.

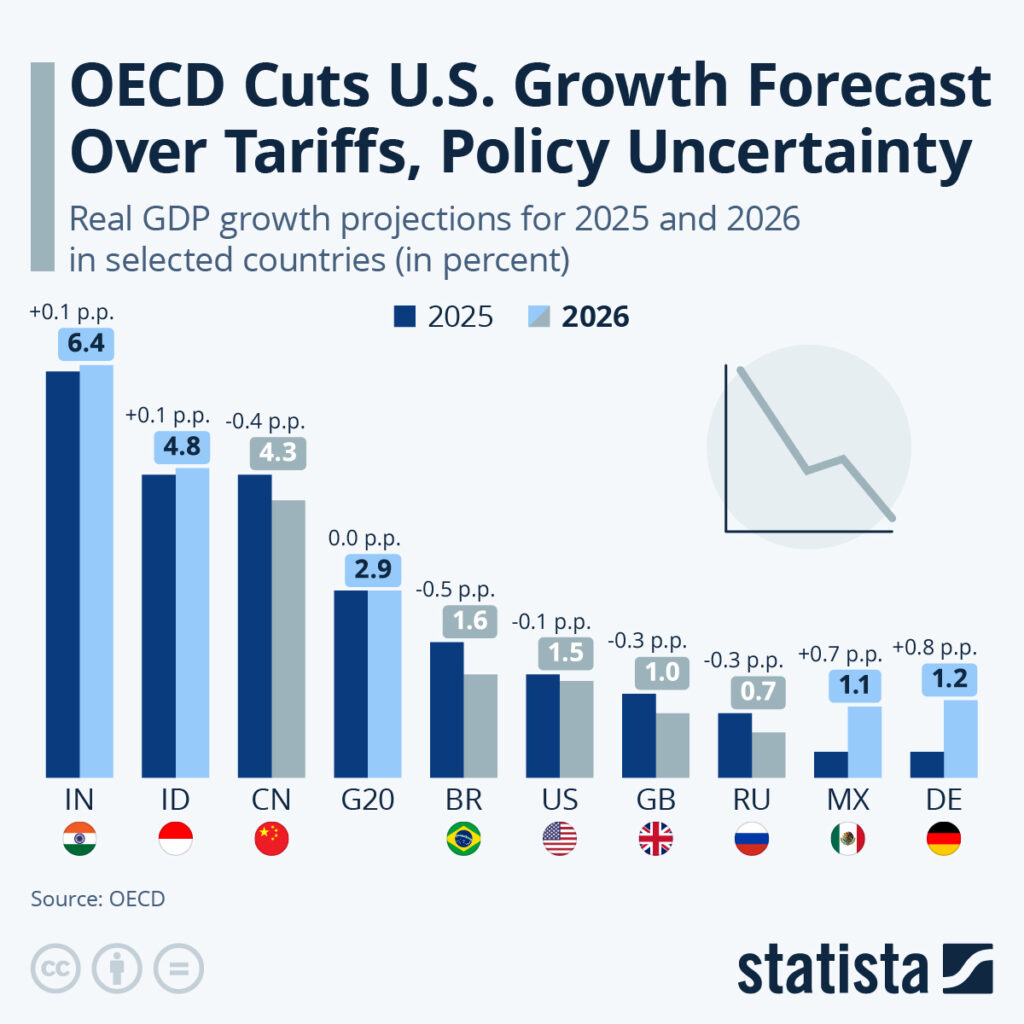

The OECD expects global GDP growth to slow from 3.3 per cent in 2024 to 2.9 per cent in both 2025 and 2026, indicating a more “challenging” outlook due to increased risks and ongoing global uncertainties.

Mounting trade barriers, tightening financial conditions, low business and consumer confidence, and rising policy uncertainty are all key contributors to the expected downturn.

The OECD warns that these headwinds are reducing the prospects for long-term economic recovery.

US economy faces a sharp decline amid tariff hikes and policy instability

The US is on course for one of the sharpest decelerations among the world’s big economies.

Economic growth is expected to decrease from 2.8% in 2024 to 1.6% in 2025 and 1.5% in 2026.

The OECD refers to this as a sharp rise in the effective tariff rate on imports and retaliation from trade partners.

Furthermore, increased economic policy uncertainty combined with large reductions in net immigration and a sizeable reduction in the federal workforce are the main domestic forces contributing to the weakness in growth, the report says.

This outlook relies on the assumption that tariff rates, as of mid-May, stay the same and marks a downgrade from the OECD’s March prediction when it saw US growth at 2.2 per cent by 2025.

North American neighbours are also expected to slow down

Canada and Mexico are not immune to the overall regional slowdown. Canada’s GDP is expected to grow by only 1% in 2025, down from 1.5% in 2024.

Mexico is predicted to have an even worse decline, with growth falling to 0.4% from 1.5%.

These results reflect the spillover effects of the US downturn, as well as the global trade environment, which remains weighed down by protectionist policies and financial tightening.

China’s growth will weaken despite tariff relief

China, which was at the centre of a tariff spat with the United States, is also expected to see a gradual slowdown.

Although some of the highest tariffs have been temporarily decreased, the country’s growth rate is predicted to slow from 5% in 2024 to 4.7% in 2025 and 4.3% in 2026.

The analysis warns that trade tensions and weak global demand will continue to influence China’s trade trajectory.

India and Indonesia emerge as growth leaders

India continues to be the best performer among the big economies, unlike the global trend.

The Indian economy is now expected to grow by 6.3% in 2025 and by 6.4% in 2026, according to the OECD.

Indonesia is expected to continue growing at a steady pace of around 4.7% in 2025 and 4.8% in 2026.

These numbers showcase the comparative strength of some emerging markets while advanced economies start to buckle under pressure.

Inflation pressures persist across G20 nations

Inflation worries also feature in the OECD report, which sees the average annual headline inflation in the group climbing to 4.2% in 2025, up from a previously forecast 3.7%.

As for Argentina, Turkey, and Russia, it is promising the highest inflation rates among the G20 with 36.6%, 31.4%, and 9.7%, respectively.

Nonetheless, although still high, these numbers are a departure from the relatively better situation in Argentina and Turkey. Those figures came in at 219.9% and 58.5% for 2024 alone.

The OECD has released the findings of its most recent economic outlook, and it tells a story of an increasingly troubled world economy in which slowing growth and stubborn inflation combine to impose a guarded forecast for the global economy over the mid-2020s.

The post OECD cuts US outlook sharply, projects India to lead global growth: key insights appeared first on Invezz