Recent uncertainty surrounding the standoff between US President Donald Trump and the Federal Reserve makes gold more attractive for investments.

Despite the US government’s unprecedented attacks on the Fed, financial markets have remained surprisingly calm.

Following Trump’s announcement of Fed Governor Lisa Cook’s dismissal, there are no signs of elevated nervousness in the stock, bond, or foreign exchange markets.

Increased uncertainty is evident in the precious metals markets, where the price of gold recently hit a new all-time high, surpassing $3,500 per ounce. This trend, however, is not observed across all financial markets.

The December gold contract on COMEX hit a record high of $3,578.20 an ounce earlier on Tuesday.

Dovish monetary policy in long term

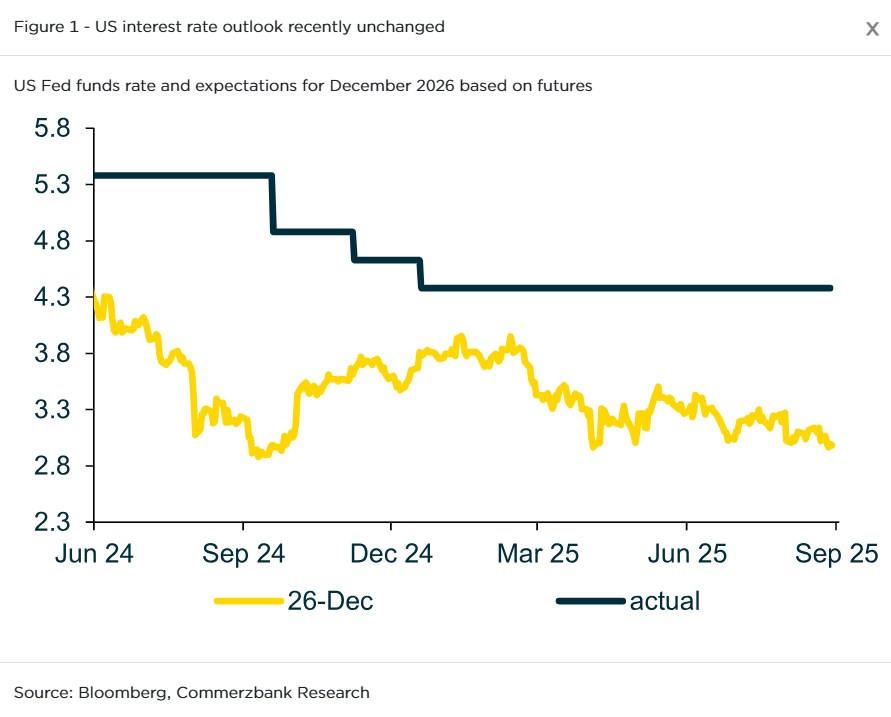

According to Commerzbank AG, the recent rally in gold prices is unlikely to be driven by the short-term US interest rate outlook, which has only changed marginally in recent days.

“In fact, the markets appeared to react more strongly to the comments made by Fed Chair Powell at the Jackson Hole central bankers’ symposium than to Cook’s dismissal,” Thu Lan Nguyen, head of FX and commodities research at Commerzbank, said in a report.

Instead, the growing concern (rightly so) is likely that the Fed’s reaction function could shift significantly toward a more dovish monetary policy in the long term.

The accusations against Cook suggest that other FOMC members may be pressured by the government to implement significant rate cuts.

This situation could lead the Fed to exercise greater caution in tightening monetary policy, even if inflation risks rise.

Consequently, there is an increased risk of elevated long-term inflation resulting from excessively low interest rates.

“This makes gold investments more attractive in such an environment,” Nguyen said.

Gold’s latest rally not extraordinary

While gold prices have risen by over $100 since Friday, this increase is not unusual when viewed against year-to-date trends.

This calm reaction may be due to the prevailing belief that Trump’s attempt at dismissal will not succeed in court, aligning with the general tranquility seen across other financial markets.

Cook has filed a lawsuit challenging her dismissal, asserting that the mortgage fraud accusations are a pretext to influence US monetary policy rather than a legitimate “cause” for her removal.

Cook, like most Fed governors, recently voted to maintain unchanged interest rates. A similar outcome, a defeat, appears plausible for Trump regarding US tariffs.

A US appeals court recently ruled that certain tariffs were unlawfully imposed, with a final Supreme Court judgment expected.

Fed may yield to Trump pressure in 2026

Nguyen said:

If it is confirmed that the checks and balances in the US remain intact and that the courts block the White House’s attempts to exert influence over the Federal Reserve, the risk of excessively lax monetary policy would also be averted for the time being.

The market’s reaction thus far would be justified in that scenario.

A slight dip in gold prices is probable. Even if Cook wins the court case and keeps her job, the US government might still find other ways to pressure the Fed into substantial rate cuts.

“For this reason, we anticipate that, next year at the latest, after Jerome Powell’s term as Fed Chair expires, the institution will yield to some extent to government pressure,” Nguyen said.

Commerzbank’s US experts currently expect two rate cuts this year and four next year, bringing the policy rate level down to 3%.

Gold to rise further

Precious metals continue to be bolstered by geopolitical factors.

The diminishing likelihood of the Ukraine war concluding soon contributes to this trend, though it doesn’t entirely account for gold’s recent substantial price increases.

Strong inflows into gold ETFs, amounting to 30 tons over the last four trading days, demonstrate the current favorable environment for gold.

On Friday, the world’s largest gold ETF experienced its most significant single-day inflow since the tariff disruptions in April.

Gold is likely to climb further in the coming months.

Nguyen added:

We project the price will reach USD 3,600 per troy ounce by the end of next year.

The post Trump and US Fed clash may push gold prices towards $3,600/oz by year-end appeared first on Invezz