Shares of American Eagle Outfitters jumped nearly 24% in premarket trading on Thursday after splashy celebrity campaigns featuring actor Sydney Sweeney and National Football League star Travis Kelce boosted demand for the apparel retailer’s jeans and fall collections.

The surge marked one of the strongest single-session rallies in the company’s history, reversing months of investor pessimism about sluggish apparel sales.

Chief marketing officer Craig Brommers said on a post-earnings call on Wednesday that the company’s fall denim push, branded under the slogan “Sydney Sweeney Has Great Jeans,” delivered “unprecedented new customer acquisition” within just six weeks of its launch in late July.

Executives also said Sweeney’s signature jeans sold out within a week.

The campaign included high-profile activations such as a Sphere takeover in Las Vegas, 3-D billboards in New York and Los Angeles, and a partnership with HBO Max’s “Euphoria.”

“Consumer acquisition is coming from every single county in the US. This momentum is national, and it is pervasive,” Brommers said.

Search interest for American Eagle spiked 186% in the week ending August 3 compared with the prior week, according to media research firm Carma.

Website traffic also grew 15% in July versus June, underscoring the impact of the campaign.

Travis Kelce collaboration adds to momentum

American Eagle also credited a limited-edition collaboration with Kansas City Chiefs tight end Travis Kelce’s Tru Kolors line for boosting foot traffic and delivering the company’s best Labor Day sales to date.

The partnership, announced shortly after Kelce’s engagement to pop star Taylor Swift captured widespread attention, has been a driver of both consumer awareness and media buzz.

Brommers said collaboration with Kelce is building momentum in the men’s category.

The retailer’s men’s business started to gain strength in July, Brommers says, and has accelerated in recent days with the launch of the new partnership.

“We’ve seen incredible interest on this first drop and expect even more in the second drop,” he says. “Travis is front and center in the national conversation,” he said.

Chief executive Jay Schottenstein told analysts that brand awareness, comparable sales and consumer engagement were all rising as a result of improved product offerings and the celebrity tie-ins.

“We have seen periods of very strong demand from both campaigns, fueling positive traffic in August, which was up consistently throughout the month,” Schottenstein said.

Analysts cautious on sustainability

While investors cheered the immediate sales boost, analysts urged caution on whether American Eagle can sustain momentum.

“A 25% leap in extended trading also bakes in a lot of faith that the celebrity-fuelled demand burst holds through the holiday season, which makes the move partly victory lap and partly future tense,” said Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors.

Others noted the retailer’s exposure to tariffs and its competitive pressures from fast-fashion rivals.

“The retailer has little room to pass costs directly from tariffs to shoppers who are already highly price-conscious and will likely have to absorb some of the margin pressure,” said Natasha Nair, analyst at Third Bridge.

American Eagle said it expects tariffs to cost it around $20 million in the third quarter, and $40 million to $50 million in the fourth quarter.

Nair added that competitors like Zara and Shein can also quickly copy trends and undercut on price, making it harder for American Eagle to defend its market share.

Broader retail challenges remain

Like other apparel retailers, American Eagle has been navigating weaker discretionary spending as US consumers tighten budgets on clothing and accessories amid economic uncertainty.

The company pulled its full-year outlook in May, citing volatility in consumer spending, but now expects comparable sales to rise modestly in the third and fourth quarters.

Executives said American Eagle is diversifying its supply chain to offset tariff pressures.

The company now expects China to account for a single-digit percentage of production, while shifting more sourcing out of Vietnam.

Pricing adjustments, supplier negotiations and logistics changes are also part of its strategy to defend margins.

Reactions to Sweeney’s campaign

Sweeney’s campaign has not been without controversy. Some longtime female shoppers suggested the tone of the advertisements strayed from American Eagle’s traditional female-focused marketing.

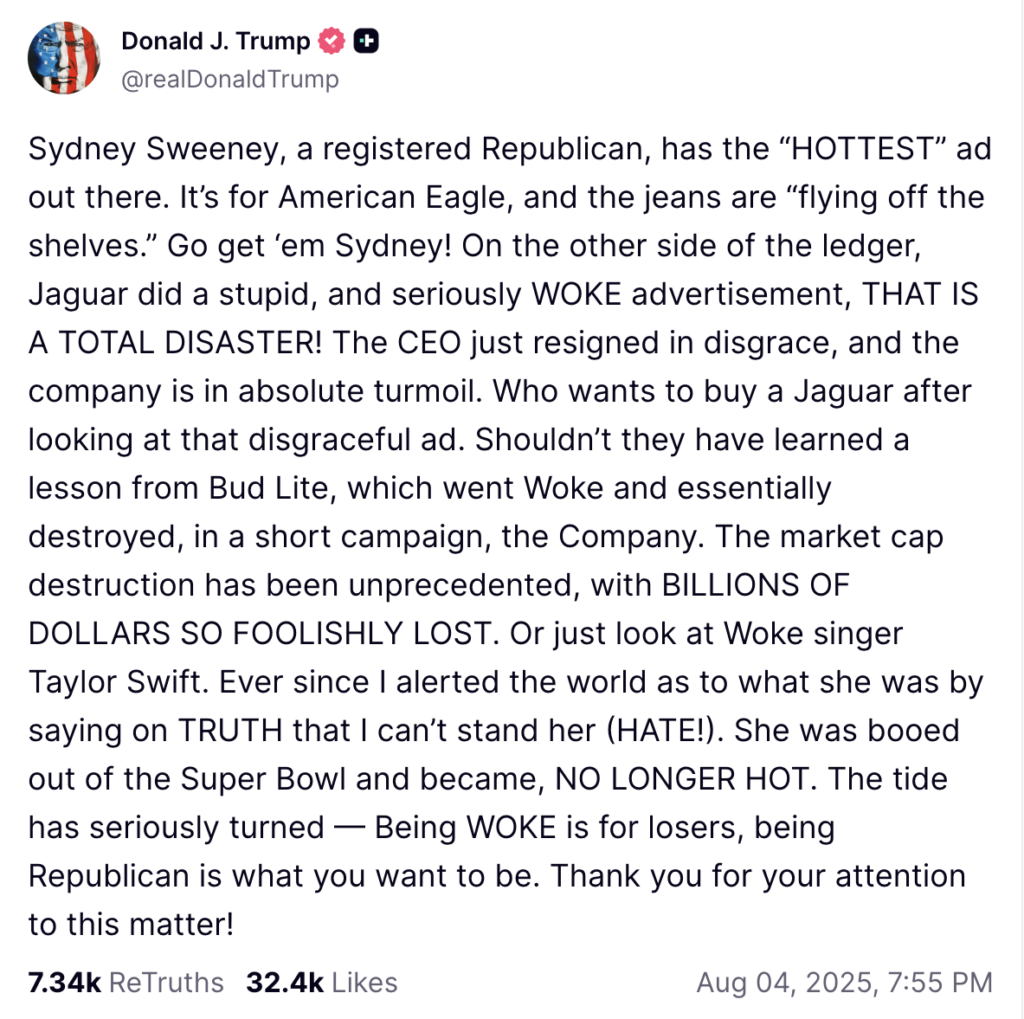

Yet others, including public figures, praised the approach. Former US President Donald Trump posted on Truth Social that Sweeney had “the hottest ad out there.”

Source: Truth Social

Trump’s praise sent the share price of American Eagle soaring by 23% in a single day last month.

American Eagle’s market share rose from 18.5% on August 2 to 19.5% on August 9, before easing back to 18.9% by late August, according to data from Consumer Edge.

The company has also partnered with other young celebrities to appeal to Gen Z shoppers, including tennis player Coco Gauff and actor Jenna Ortega.

Financial results show mixed picture

For the fiscal second quarter ended August 2, American Eagle reported net income of $77.6 million, up slightly from $77.3 million a year earlier.

Total net revenue fell 1% to $1.28 billion, but still topped Wall Street estimates of $1.24 billion, according to FactSet.

Comparable sales across the company declined 1%, with sales down 3% at the American Eagle brand but rising 3% at its Aerie chain.

Executives said they expect sales growth to stabilize through the remainder of the year, driven by the high-profile campaigns and back-to-school demand.

Still, with stock gains hinging on the durability of celebrity-driven momentum, analysts say the results of the holiday season will be critical in determining whether American Eagle’s marketing gambit pays off.

The post American Eagle stock soars 24% as Sydney Sweeney’s ‘Great Jeans’ campaign boosts sales appeared first on Invezz