Before the elections, the cryptocurrency industry was characterized by scrutiny, strict policies, and lawsuits. But things are changing rapidly.

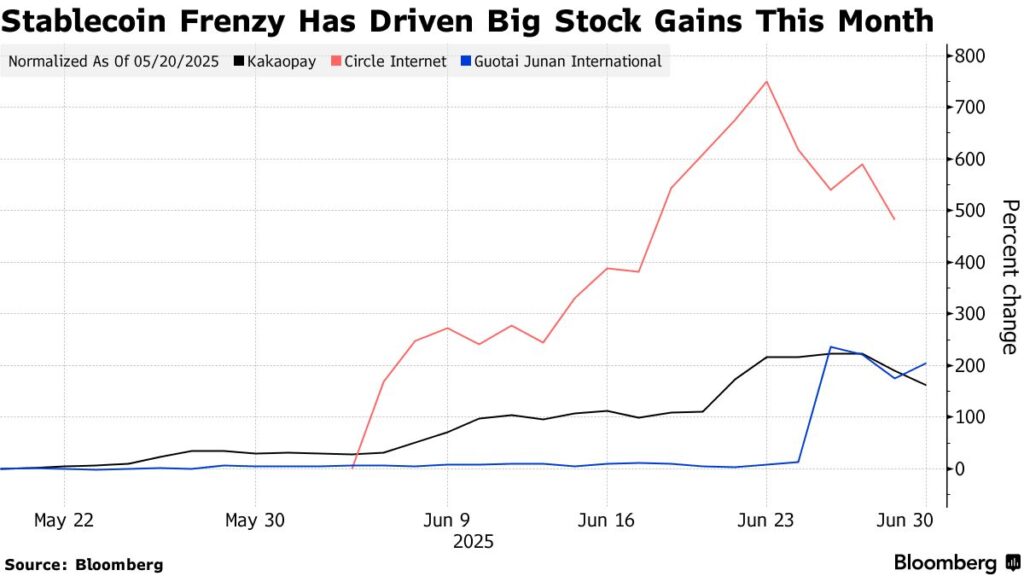

This month, the Senate passed the GENIUS Act, a bill designed to regulate stablecoins and bring digital assets under federal oversight.

This is the first time either chamber has approved major crypto legislation.

And with the House now preparing a joint vote on two bills, the United States may soon have its clearest crypto framework yet.

What does the GENIUS Act actually do?

The GENIUS Act sets out to regulate stablecoins, which are digital tokens pegged to traditional currencies like the US dollar.

These coins are meant to offer price stability and are often used for transactions within crypto platforms or across borders.

Read also: A financial revolution: how stablecoins are revamping the global payments industry

The bill mandates that issuers maintain fully backed reserves, give investors priority in bankruptcy, and comply with anti-money laundering and terrorism financing rules.

A new regulatory board will oversee approvals of new stablecoin issuers.

Supporters say it’s about modernizing payments and reinforcing the dollar’s dominance in a digital age.

Senator Bill Hagerty, the bill’s sponsor, argued that the US must act or risk losing ground in financial innovation.

His thesis is that since Americans are already using stablecoins, Washington should support, not oppose.

What does the public really want from crypto regulation?

According to CoinCover’s latest Trust Factor Report, the appetite for stronger guardrails is clear.

In a survey of over 1,000 individuals across multiple regions, 82% said they believe the crypto industry needs a global regulatory framework.

67% said they’d be more likely to invest, or invest even more, if crypto were regulated like traditional assets such as stocks and bonds.

The takeaway is simple: users aren’t rejecting oversight. They’re asking for it.

Almost half of the respondents had either experienced or witnessed irreversible losses due to scams, fraud, or lost access to wallets.

That explains why nearly 80% supported compensation schemes for victims of hacks or technical failures.

The message is not that regulation threatens innovation.

The opposite is true. It’s that meaningful oversight is a prerequisite for trust, adoption, and scale.

Do experts agree on what kind of regulation is needed?

The Trust Factor Report doesn’t just reflect retail sentiment. It also draws from interviews with some of the industry’s most active operators and legal experts.

And while their perspectives vary, most agree on one thing: traditional financial rules don’t work for crypto.

Unlike banks or broker-dealers, crypto companies are often vertically integrated.

They operate exchanges, custody wallets, and staking services, all under one roof.

Applying legacy frameworks built for siloed institutions only increases friction.

Instead, experts call for tailored regulation that reflects the technology’s structure.

Regulation should match how value moves, how custody is handled, and how risk is distributed, not just how a service looks on paper.

They also stress the importance of stablecoin clarity. When reserve rules and issuer obligations are clear, capital can flow more freely.

That means more involvement from hedge funds, family offices, and even traditional banks.

Consumer protection is another top priority. The failures of FTX, Celsius, and Terra have shown that transparency around reserves and internal controls isn’t optional. It’s essential.

There’s also broad consensus that global alignment is coming, even if full harmonization isn’t realistic.

Core principles like anti-money laundering, cybersecurity, and market integrity are expected to converge, especially among Western regulators.

Finally, privacy and decentralization are key topics of discussion.

But the dominant view is that regulators should focus on access points like exchanges and wallet providers without trying to police decentralized protocols themselves.

The goal is to protect users, not force the industry back into centralized models.

Why the US and Europe are moving in different directions

The GENIUS Act is part of a wider effort that sets the US apart from other jurisdictions.

Under the Trump administration, the US is leaning into permissive, business-friendly policies, especially when it comes to stablecoins.

That stands in contrast to the European Union’s MiCA framework, which is broader in scope and significantly more restrictive.

MiCA introduces high compliance requirements, strict license terms, and clear boundaries around stablecoins, NFTs, and DeFi.

Some see MiCA as a benchmark for institutional trust. Others view it as a barrier that could push innovation elsewhere.

In the UK and UAE, hybrid approaches are emerging.

These jurisdictions are trying to balance sandbox-style flexibility with long-term clarity, hoping to position themselves as innovation hubs without sacrificing security or investor protection.

The divergence is especially important as capital, talent, and startups will gravitate toward the jurisdictions that offer both regulatory clarity and room to grow.

What happens next?

The House is expected to vote on the GENIUS Act in early July, possibly bundling it with the Clarity Act, which addresses crypto market structure more broadly.

That strategy could accelerate both bills or stall them, depending on political dynamics.

Trump has been publicly pushing for speed. But internal divisions and concerns over bundling may cause delays, especially as the Clarity Act faces scrutiny in the Senate’s Banking and Agriculture Committees.

If passed, the GENIUS Act will immediately bring stablecoins under federal oversight.

That would likely trigger a wave of compliance efforts among US-based issuers and could prompt institutional players to enter the market.

Looking further ahead, we can expect more state-level frameworks to emerge, especially as regulators attempt to address gaps left by federal legislation.

Meanwhile, other countries will be waiting to see if the US gains a competitive advantage by moving first on stablecoin regulation.

The post Is the US about to pass the most industry-friendly crypto law yet? appeared first on Invezz